Business

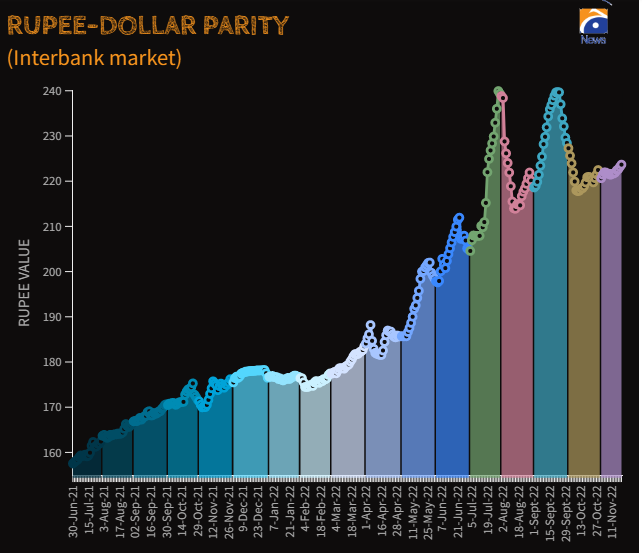

Rupee’s woeful ride continues, depreciates to settle at 223.66 against dollar

-

Latest News2 days ago

Latest News2 days agoThree injured and two died in a Punjabi road accident

-

Latest News3 days ago

Latest News3 days agoPM Shehbaz will meet with Saudi ministers and speak at the WEF special session today.

-

Latest News3 days ago

Latest News3 days agoThe nomination of Ishaq Dar as deputy prime minister raises concerns.

-

Latest News2 days ago

Latest News2 days agoFazl challenges the authenticity of the parliament.

-

Business2 days ago

Business2 days agoPakistan’s $1.1 billion loan tranche is approved by the IMF board.

-

Business2 days ago

Business2 days agoPakistan’s fuel prices should drop.

-

Latest News2 days ago

Latest News2 days agoJudges of the IHC letter: Today’s suo moto case will be taken up by the six-member SC bench

-

Latest News2 days ago

Latest News2 days agoLahore experiences a winter-like ambiance following rainfall.