Business

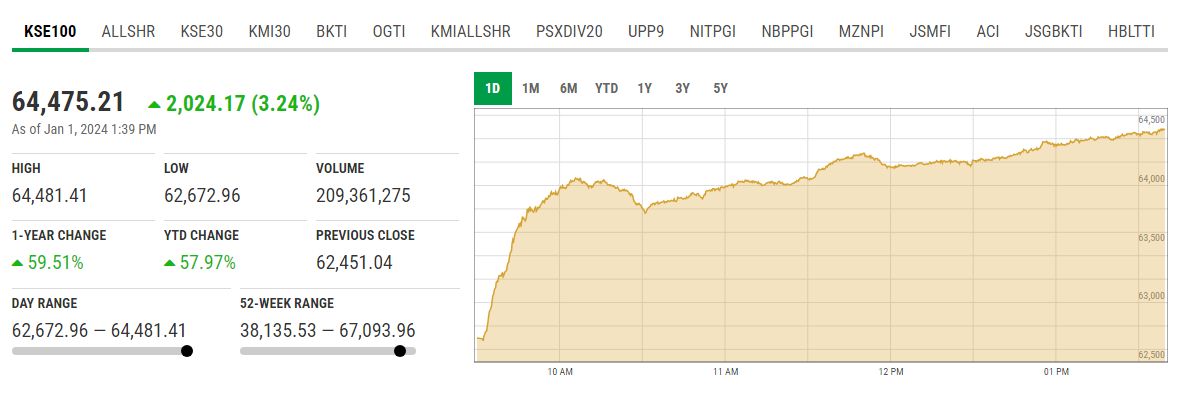

PSX starts 2024 in green as KSE-100 surges by over 2,000 points

-

Business21 hours ago

Business21 hours agoThe International Monetary Fund (IMF) and Pakistan have initiated discussions at the policy level.

-

Latest News21 hours ago

Latest News21 hours agoAbbasi says that Pakistan’s functioning will not be efficient without implementing improvements in the system.

-

Latest News21 hours ago

Latest News21 hours agoThe bail petition of Parvez Elahi in the Jinnah House attack case has been rejected by the ATC.

-

Latest News22 hours ago

Latest News22 hours agoAitchison College appoints a new principal.

-

Latest News21 hours ago

Latest News21 hours agoAdditional Pakistani students evacuated from Bishkek, which has been affected by unrest.

-

Latest News21 hours ago

Latest News21 hours agoPakistan and Turkey have reached an agreement to enhance their bilateral commerce to a total of $5 billion.

-

Latest News21 hours ago

Latest News21 hours agoStatement from the chief meteorologist regarding the Karachi heatwave:

-

Latest News21 hours ago

Latest News21 hours agoThe matriculation exams in Karachi have been rescheduled.