Business

Govt increases gas tariff for 3 fertilizer plants to unify rates

-

Latest News3 days ago

Latest News3 days agoThree injured and two died in a Punjabi road accident

-

Business17 hours ago

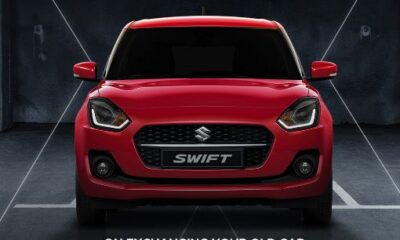

Business17 hours agoSee the new rates when Pak Suzuki announces a significant decrease in car costs.

-

Latest News16 hours ago

Latest News16 hours agoPoliovirus discovered in ten additional sewage samples

-

Business3 days ago

Business3 days agoPakistan’s $1.1 billion loan tranche is approved by the IMF board.

-

Business3 days ago

Business3 days agoPakistan’s fuel prices should drop.

-

Latest News3 days ago

Latest News3 days agoJudges of the IHC letter: Today’s suo moto case will be taken up by the six-member SC bench

-

Latest News3 days ago

Latest News3 days agoFazl challenges the authenticity of the parliament.

-

Latest News3 days ago

Latest News3 days agoAfter kidnapping a citizen of Karachi, three AVLC officers were detained.