KARACHI: Pakistan’s rupee Tuesday turned the losing tide on the dollar, bouncing off eight-session lows, dealers said.

The local currency gained Re0.24 or 0.11% against the greenback in the inter-bank market to close at 223.42. That compared to Monday’s close of Rs223.66

The country’s currency has shed Rs2 or 0.9% versus US currency during the last eight trading sessions.

Analysts said that even the improvement in the country’s current account balance failed to cheer up the rupee. The current account deficit fell 68% to $567 million in October.

The market sentiment is negatively impacted by Pakistan’s growing risk of default on its obligations to repay foreign debt, the delay in IMF-Pakistan negotiations, and the absence of a timeframe regarding incoming financing from friendly countries, according to dealers.

The current account gap has reduced, but exports and remittances have taken a serious hit.

Inflows have dried down, and traders are keenly looking out for World Bank to send in aid money, so crucial at this time.

The general consensus in the money market remains downbeat.

However, positive news from the political and inflows front was seen setting the rupee’s direction down the line.

Dollar shortage

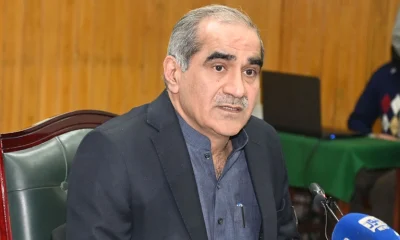

Zafar Paracha, Chairman Exchange Association of Pakistan (ECAP), sees the rupee languishing in the near future owing to multiple reasons.

“First off, there’s a shortage of dollars in the country. We have more buyers than sellers in the market,” Paracha said highlighting the dollar demand-supply issues.

He said the country was in dire need of big inflows and “as long as the international and bilateral lenders do not deliver on their commitments, the rupee is unlikely to recover.

“One of the reasons that have stalled these inflows was the ongoing political uncertainty in the country.” he said adding, “While IMF is also not giving us any leverage and is tightening its conditions, adding to the economic woes”.

Another reason was that remittances from overseas workers were continuously falling, which was an upshot of the global recession.

“This phenomenon has weighed on the savings of expats, resulting in lower amounts of foreign currency being sent home,” the ECAP official added.

Paracha also raised alarms over the thin foreign exchange stash with the central bank, fearing more fiscal pressure as deadlines for the repayments of maturing external debt and interest expenses were approaching fast.

The money dealers’ association leader pointed out that the grey market was also biting into the legal one.

“People are diverting to the illegal channels as they are offering better rates, which also need to be addressed,” Paracha said.

Dollar stable

The dollar steadied on Tuesday after rallying the previous day as investors flocked to the safe haven currency on worries over China’s COVID flare-ups, while bitcoin came under pressure after fears of fresh contagion from the collapse of crypto exchange FTX.

The euro was up 0.14% to $1.0258 after an 0.8%loss on Monday, the sterling rose 0.19% to $1.1838, partially reversing its 0.6% fall, and the dollar was at 141.86 yen down 0.18% after a 1.2% gain.

Latest News2 days ago

Latest News2 days ago

Business2 days ago

Business2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Business2 days ago

Business2 days ago

Latest News2 days ago

Latest News2 days ago