Business

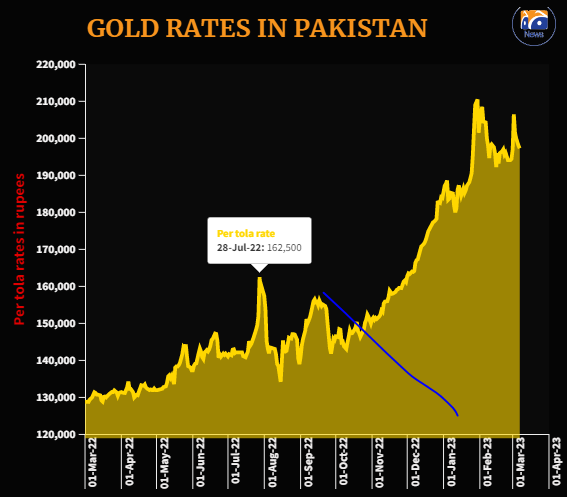

Why gold prices not released in Pakistan today?

-

Entertainment2 days ago

Entertainment2 days agoReham Khan’s counsel to Hania Amir between marriage versus career

-

Latest News1 day ago

Latest News1 day agoThe government and the military are successfully combating drug abuse through a nationwide anti-drug operation.

-

Latest News1 day ago

Latest News1 day agoAt a ceremony held at Mirpur, the Prime Minister of Jammu and Kashmir stated, “We will not hesitate to make any sacrifice for peace in the region.”

-

Latest News1 day ago

Latest News1 day agoThe 26th Amendment to the Constitution: The Amendment That Completes the Charter of Democracy: Bilawal

-

Latest News1 day ago

Latest News1 day agoIn the border region, a Lahore police officer was detained for allegedly using drones to smuggle drugs.

-

Entertainment2 days ago

Entertainment2 days agoThe Punjab government initiates the ‘Dhee Rani’ initiative for underprivileged couples.

-

Latest News1 day ago

Latest News1 day agoPakistan’s Deputy Prime Minister will be present at the Commonwealth Heads of Government Meeting, which will take place in Samoa.

-

Latest News1 day ago

Latest News1 day agoJudicial Appointments in the Supreme Court Will Be Made Transparent: Law Minister