Business

What could be the petrol price in Pakistan from June 1?

-

Latest News3 days ago

Latest News3 days agoThe Chief Minister of Punjab has given his approval for the implementation of a laptop scheme aimed at providing laptops to students.

-

Latest News3 days ago

Latest News3 days agoThe ‘clinics on wheels’ initiative is introduced by CM Maryam.

-

Latest News3 days ago

Latest News3 days agoRain that calms nerves in Islamabad, Pakistan

-

Latest News3 days ago

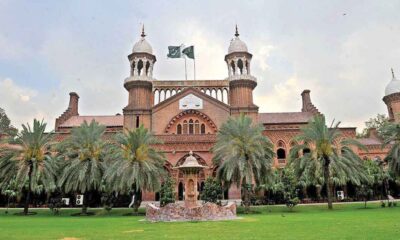

Latest News3 days agoNoticing the court closure, LHC issues an order for impenetrable security.

-

Latest News14 mins ago

Latest News14 mins agoIn the wheat import controversy, Anwarul Haq Kakar denies claims.

-

Latest News10 mins ago

Latest News10 mins agoDeputy Prime Minister Ishaq Dar travels to China to discuss trade and economic relations.

-

Business20 mins ago

Business20 mins agoOn this day, the FY2024–25 budget will be “presented.”