Business

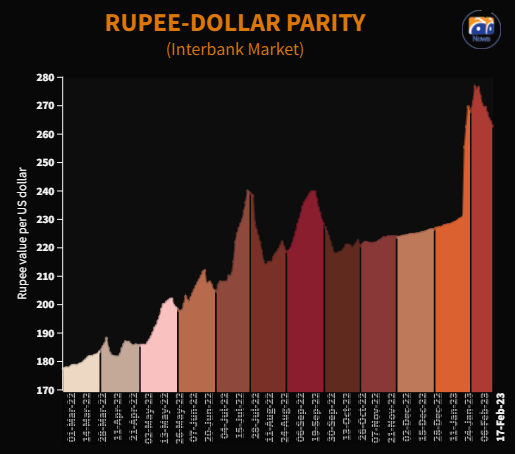

Rupee rally continues unabated over improved dollar supply

-

Latest News2 days ago

Latest News2 days agoThe PML-N Punjab chapter convenes today to discuss organizational issues.

-

Business2 days ago

Business2 days agoThere are US$13,280.5 million in foreign exchange reserves in Pakistan.

-

Latest News2 days ago

Latest News2 days agoIn Punjab, the PDMA issued an alert for rain and snowfall.

-

Latest News2 days ago

Latest News2 days agogovernment starts a trail patrol in the Margalla Hills of Islamabad

-

Latest News2 days ago

Latest News2 days agoSaad Rafiq: Ali Amin Gandapur’s threat to storm Islamabad is a major issue.

-

Latest News2 days ago

Latest News2 days agoSeveral Pakistani airports will get new COOs

-

Latest News2 days ago

Latest News2 days agoThe first Air Ambulance Service training session in Pakistan begins.

-

Business2 days ago

Business2 days agoNIMA seminar to increase Pakistan’s ship recycling industry’s capacity