Business

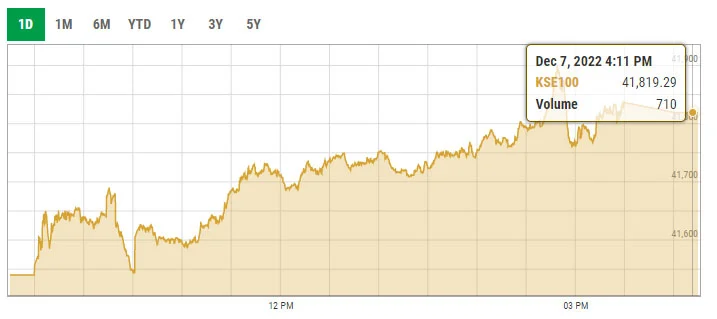

PSX hails govt’s clarification on economic emergency with 280-point rise

-

Latest News3 days ago

Latest News3 days agoFederal Cabinet once again postpones decision on PTI suspension and Article 6 action against Imran and Alvi

-

Latest News3 days ago

Latest News3 days ago52 districts in Pakistan have 52 cases of the polio virus.

-

Latest News3 days ago

Latest News3 days agoThe 10th Executive Committee Meeting of SIFC examines the role of provinces in bringing in foreign investment.

-

Latest News3 days ago

Latest News3 days agoCabinet will probably decide today whether to ban PTI: Fawad ChaudhryCabinet will probably decide today whether to ban PTI: Fawad Chaudhry

-

Entertainment3 days ago

Entertainment3 days agoA glimpse of Sania Mirza’s relaxed moments

-

Latest News3 days ago

Latest News3 days agoElection Amendment Act Case Heard by IHC; Response Requested From Law Ministry, ECP Within Ten Days

-

Latest News3 days ago

Latest News3 days agoPakistan has advanced to the Women’s Asia Cup 2024 semifinals.

-

Latest News3 days ago

Latest News3 days agoThe PM expresses gratitude for the Beijing Declaration for the Palestine Interim Government.