Pakistan

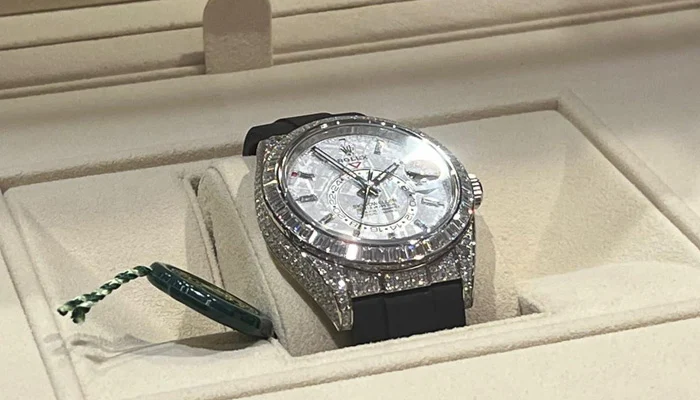

PM Shehbaz deposits all gifts in Toshakhana, govt says

Latest News

Rainfall throughout the night stops flights in Lahore.

Latest News

Changes to Pakistan’s Test team could be significant for the Bangladesh series.

Latest News

PM Meets With KP Lawmakers: Promises Progression and Relief Efforts in Province

-

Latest News2 days ago

Latest News2 days agoPrime Minister and Secretary General of ECO Hold Meeting

-

Latest News2 days ago

Latest News2 days agoUS Will Not Interfere in Pakistan’s Internal Matters: Miller

-

Business2 days ago

Business2 days agoA jail sentence and heavy fines were declared for fake tax documents.

-

Latest News2 days ago

Latest News2 days agoThe ECP asks the SC to clarify the ruling in the PTI reserved seat case.

-

Latest News2 days ago

Latest News2 days agoPM Youth Programme: Shehbaz Sharif Makes Critical Choices To Give Youth Jobs

-

Business2 days ago

Business2 days agoThe price of gold has drastically dropped in Pakistan.

-

Latest News23 hours ago

Latest News23 hours agoRainfall throughout the night stops flights in Lahore.

-

Entertainment2 days ago

Entertainment2 days agoFilming for “Yeh Ishq” begins with Sheheryar Munawar and Ushna Shah.