Business

In a new IMF agreement, Pakistan would “raise” the FBR tax-to-GDP ratio to 15%.

-

Latest News2 days ago

Latest News2 days agoTandoor de-sealing and worker release are mandated by court rulings.

-

Latest News3 days ago

Latest News3 days agoCM Maryam resolved to avert tragedies like May 9.

-

Latest News3 days ago

Latest News3 days agoAccording to CPLC data, Karachi saw 4,184 motorbike thefts and 59 fatalities in April.

-

Latest News3 days ago

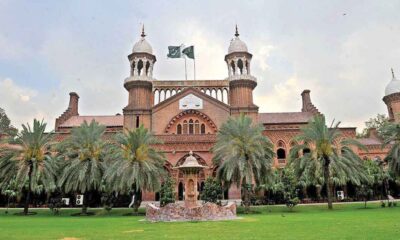

Latest News3 days agoHajj flight delayed due to airport fire in Lahore

-

Latest News3 days ago

Latest News3 days agoSher Afzal Marwat has been removed from the PTI’s political committee.

-

Latest News3 days ago

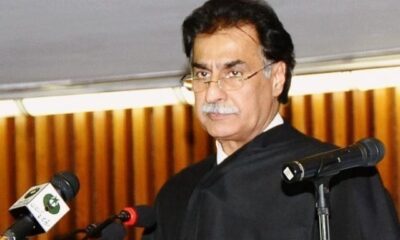

Latest News3 days agoAn NA speaker describes May 9 as the darkest day in the country’s history.

-

Latest News2 days ago

Latest News2 days agoProposal to smuggle diesel foiled by Customs

-

Latest News2 days ago

Latest News2 days agoThe Chief Minister of Punjab has given his approval for the implementation of a laptop scheme aimed at providing laptops to students.