Business

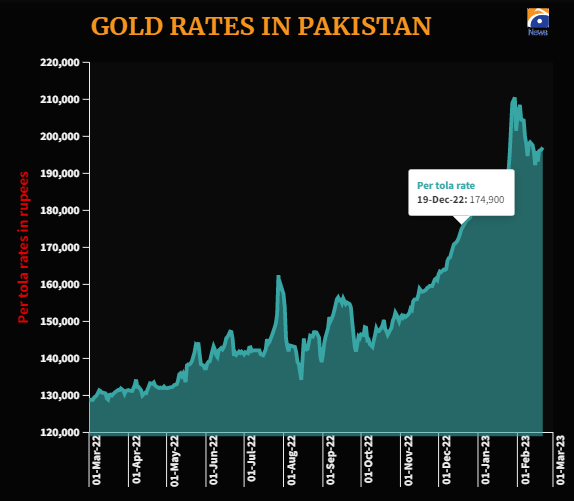

Gold climbs on third day as rupee pauses its winning streak

-

Business2 days ago

Business2 days agoA jail sentence and heavy fines were declared for fake tax documents.

-

Latest News2 days ago

Latest News2 days agoThe ECP asks the SC to clarify the ruling in the PTI reserved seat case.

-

Latest News2 days ago

Latest News2 days agoUS Will Not Interfere in Pakistan’s Internal Matters: Miller

-

Business2 days ago

Business2 days agoThe price of gold has drastically dropped in Pakistan.

-

Latest News2 days ago

Latest News2 days agoPrime Minister and Secretary General of ECO Hold Meeting

-

Latest News2 days ago

Latest News2 days agoPM Youth Programme: Shehbaz Sharif Makes Critical Choices To Give Youth Jobs

-

Latest News2 days ago

Latest News2 days ago63,000 Instagram accounts are deleted by Meta

-

Business2 days ago

Business2 days agoIPPs in Pakistan are receiving billions of rupees while not generating any electricity.