Business

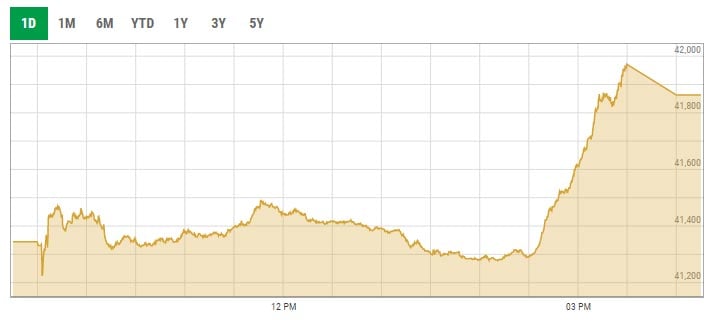

KSE-100 gains over 500 points on hopes of IMF programme revival

-

Latest News1 day ago

Latest News1 day agoPM Shehbaz will meet with Saudi ministers and speak at the WEF special session today.

-

Latest News14 hours ago

Latest News14 hours agoThree injured and two died in a Punjabi road accident

-

Latest News1 day ago

Latest News1 day agoIn KP rain-related incidents, ten people died.

-

Latest News2 days ago

Latest News2 days agoPunjab takes action against factories that generate smoke.

-

Latest News1 day ago

Latest News1 day agoThe green colour of WhatsApp ‘angers’ some users.

-

Business1 day ago

Business1 day agoOver 500 points are lost by PSX stocks during intraday trading.

-

Latest News1 day ago

Latest News1 day agoThe nomination of Ishaq Dar as deputy prime minister raises concerns.

-

Latest News1 day ago

Latest News1 day agoAudio leaks case: FIA, PTA, and PEMRA pleas seeking Justice Sattar’s recusal dismissed