- Pakistan inks Debt Service Suspension Agreement with Korea.

- This amount will now be repaid over a period of six years.

- Pakistan has already signed 104 pacts with 21 bilateral creditors.

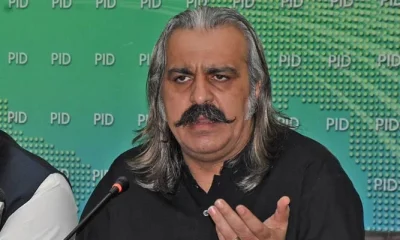

ISLAMABAD: In a sigh of relief, the Republic of Korea deferred Pakistan’s loan worth $19.911 million, under the G-20 Debt Service Suspension Initiative (DSSI) framework on Monday.

The cash-strapped country inked a Debt Service Suspension Agreement with Korea on Monday. This amount, initially had to be repaid between July and December 2021, will now be repaid over a period of six years (including a one-year grace period) in semi-annual instalments, said a statement issued by the Economic Affairs Division (EAD).

Due to the support extended by the development partners of Pakistan, the G-20 DSSI has provided the fiscal space which was necessary to deal with the urgent health and economic needs of the country.

The total amount of debt, that is to be suspended under the DSSI framework, covering the period of repayment from May 2020 to December 2021, stands at $3,686 million.

Pakistan has already concluded and signed 104 agreements with 21 bilateral creditors for the deferment of its debt repayments under the G-20 DSSI, amounting to $3,633 million.

The signing of the above-mentioned agreement brings this total to $3,653 million. Negotiations for the remaining agreements to be signed under the G-20 DSSI are ongoing.

It is pertinent to mention here, as the International Monetary Fund (IMF) is reluctant to strike a staff-level agreement without seeking confirmation on the external financing gap, Pakistan, meanwhile, conveyed to the global creditor’s staff to conclude the ninth review otherwise budgetary framework for 2023-24 would not be shared.

The lingering differences between the IMF and Pakistan are heading towards an “unbreakable deadlock” whereby Pakistani authorities claim that the confirmation of $4 billion financing was shared with the IMF even with its full details and break-up but the Fund was playing “politics” by not moving towards striking an agreement despite passing six months period.

The ninth review was due in November 2022 but the two sides have not yet reached consensus.

The patience of Pakistani high-ups is running out as they argue before the IMF officials that Islamabad should be treated as a member of the Washington-based creditor, not a beggar.

The Pakistani authorities are hopeful that the current account deficit would remain surplus for April 2023 when the numbers would come out in the next few days.

The financing gap of $4 billion was fulfilled by getting confirmation as the Kingdom of Saudi Arabia conveyed to the IMF that they were ready to provide an additional $2 billion in deposits and UAE $1 billion.

The World Bank is committed to providing $450 million RISE-II after fulfilment of four prior conditions and $250 million by the AIIB. Pakistan also received firm commitments for getting $350 million out of total Geneva pledges for flood-affected areas.

The only remaining amount is $1 billion from commercial banks and they are waiting for IMF’s deal.

The Pakistani officials argue that the external financing requirements had been fulfilled, so there was no justification for using delaying tactics to avoid signing the agreement.

Keeping in view this situation, the Ministry of Finance is all set to share the Budget Strategy Paper (BSP) with the federal cabinet without sharing it with the IMF in its meeting scheduled to be held today (Monday).

Education2 days ago

Education2 days ago

Business2 days ago

Business2 days ago

Business2 days ago

Business2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News2 days ago

Latest News1 day ago

Latest News1 day ago

Latest News2 days ago

Latest News2 days ago