- No MPC meeting held to date since last month, says SBP.

- Market expects SBP to raise benchmark interest rates.

- Government agreed to hike interest rate from 17% to 19%.

The State Bank of Pakistan (SBP) on Tuesday “preponed” its Monetary Policy Committee (MPC) meeting on March 2 — which was initially scheduled to meet for March 16 — in another attempt to increase the pace of efforts to secure the much-awaited International Monetary Fund’s (IMF) tranche.

The SBP announced on its official Twitter handle that “the forthcoming meeting of the Monetary Policy Committee has been preponed and now it will be held on Thursday, March 02, 2023,” the central bank announced on its Twitter handle.

The SBP’s chief spokesperson Abid Qamar had said earlier that, following the meeting last month, no MPC meeting had been held to date.

The MPC was established under the SBP’s Amendment Act, which is empowered to take a decision keeping in view the macroeconomic fundamentals.

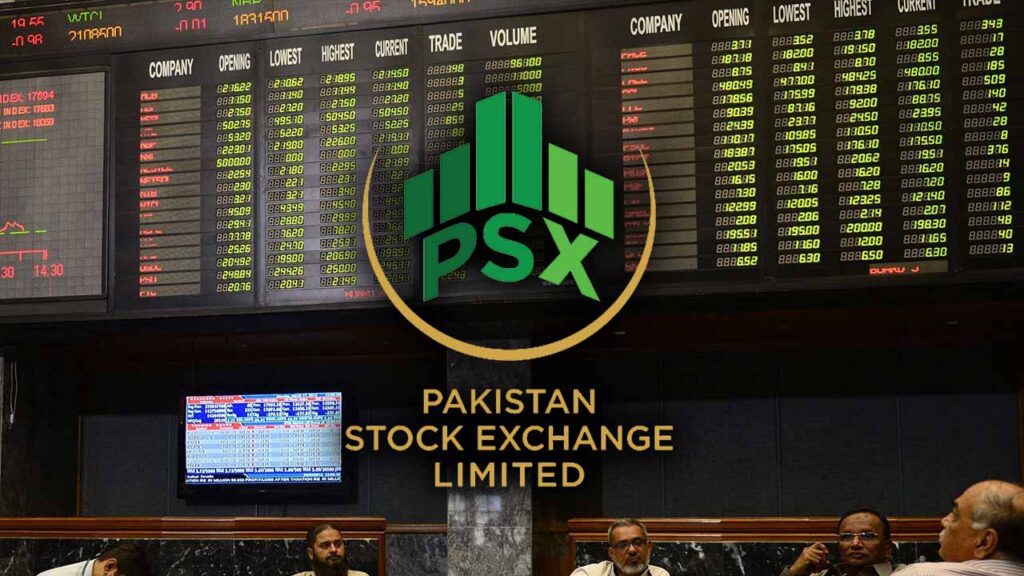

The market expects the SBP to raise benchmark interest rates as the rise in treasury yields in the last auction hinted towards market weighing-in concerns on the economic front with the investors continuing to take note of rising inflation around the world as well as in Pakistan, Arif Habib Limited stated in a commentary released earlier.

Moreover, sources had told Geo News last week thatthe coalition government had agreed to hike the interest rate from the existing level of 17% to 19% under one of the major conditions put forth by the Fund to revive the loan programme.

However, analysts believed that the SBP needed to bring forward the MPC meeting date as the ministry of finance cannot afford failure in the next T-bill auction.

It is to be highlighted that the Fund and the central bank had held a round of discussions about the possibility of further tightening of monetary policy and building up foreign exchange reserves by the end of June 2023.

The IMF had also asked the SBP for hiking the policy rate by 300 to 400 basis points in order to move towards the interest rate from a negative to a positive trajectory.

The cash-strapped country is undertaking key measures to secure IMF funding, including raising taxes, removing blanket subsidies, and artificial curbs on the exchange rate. While the government expects a deal with IMF soon, media reports say that the agency expects the policy rate to be increased.

Off-cycle rate reviews are not uncommon in Pakistan, though.

Adnan Sheikh, Assistant Vice President of Research at Pak Kuwait Investment Company, said that a rate hike is imminent.

Fahad Rauf, Head of Research at Ismail Iqbal Securities, said that the IMF has given a target to at least keep rates higher than core inflation.

“Pakistan has two core inflation readings i.e., urban (15.4% for Jan-23) and rural (19.4%) and no national core number is released. If the SBP tries to bring rates above rural core inflation, it requires a rate hike of 200-300 bps,” he said.

Mohammad Ayub Khuhro, a fund manager at a local fund, said that recent economic data on government finances suggest that it was running low on its cash balances held with the central bank.

“This is why the government went ahead with picking up their desired targets despite a signalling effect it would send to the markets,” Khuhro said.

“The government has effectively bypassed the central bank in order to fulfil IMF conditions by accepting a higher cut-off,” he added.

Latest News2 days ago

Latest News2 days ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News2 days ago

Latest News2 days ago

Latest News1 day ago

Latest News1 day ago

Latest News2 days ago

Latest News2 days ago

Education2 days ago

Education2 days ago

Latest News2 days ago

Latest News2 days ago