Business

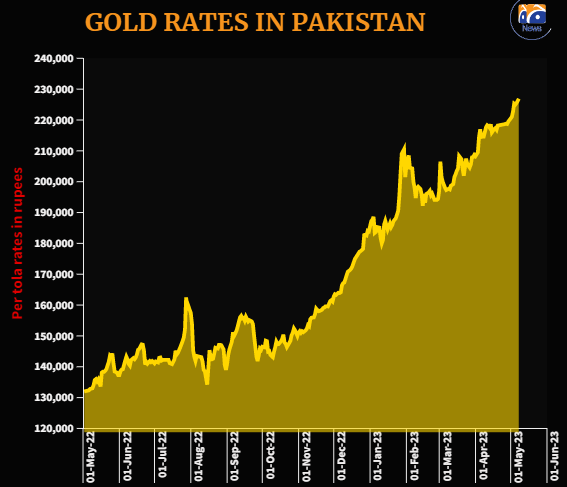

Gold rate jumps to another all-time high in Pakistan

-

Latest News2 days ago

Latest News2 days agoPakistani reforms discussed by IMF chief and finance minister

-

Latest News1 day ago

Latest News1 day agoChief of Staff of the Turkish Army, called COAS

-

Latest News2 days ago

Latest News2 days agoSenior PML-N leaders want the X ban lifted.

-

Latest News1 day ago

Latest News1 day agoRain cancels out Pakistan vs. New Zealand’s opening Twenty20 international

-

Latest News2 days ago

Latest News2 days agooath-taking ceremony for the Balochistan cabinet postponed

-

Business2 days ago

Business2 days agoDonald Lu visits Finance Minister Aurangzeb at the World Bank headquarters.

-

Latest News2 days ago

Latest News2 days agoThe government of Punjab will introduce Himmat and Nigheban cards. Who is going to gain from this?

-

Latest News2 days ago

Latest News2 days agoThe CAA chairman expects EU flight restrictions to be lifted next month.