- SBP is now engaged in needful documentation, Dar says.

- Last week, IMF indicated it has received assurance from Riyadh.

- IMF is securing confirmation from international partners.

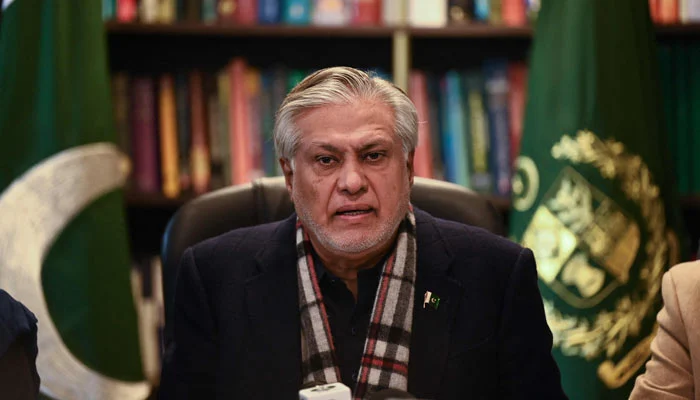

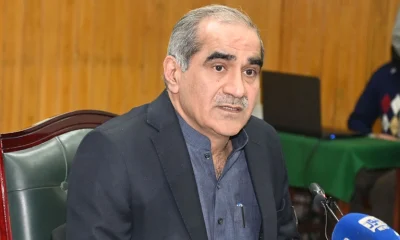

Finance Minister Ishaq Dar on Friday announced that the United Arab Emirates (UAE) authorities have informed the International Monetary Fund (IMF) about their plans of providing $1bn support to Pakistan.

The move will pave way for Pakistan to unlock the critical $1.1 billion loan tranche from the IMF as the Fund was securing confirmation from international partners to meet the financing gap requirements of Pakistan.

“UAE authorities have confirmed to IMF for their bilateral support of [$1] billion to Pakistan,” Dar announced on Twitter.

The finance minister added that the State Bank of Pakistan (SBP) is now engaged in needful documentation for taking the said deposit from the UAE authorities.

Last week, the Washington-based Fund conveyed to Pakistan that it had received confirmation from Saudi Arabia on $2 billion in additional deposits.

“The IMF has indicated it has received the assurance from Riyadh”, State Minister for Finance Aisha Ghaus Pasha told reporters in Islamabad last week.

Saudi Arabia’s $2 billion and UAE’s $1 billion pledged in external financing support to Pakistan is one of the final conditions for an IMF deal that Islamabad needs to avert a default.

Pakistan has less than a month’s worth of foreign exchange reserves and is awaiting a bailout package of $1.1 billion from the IMF that has been delayed since November over issues related to fiscal policy adjustments.

‘Pakistan had not reached default level yet’

A day earlier, IMF Managing Director Kristalina Georgieva said that Pakistan had not reached the default level yet.

Georgieva, while addressing a news conference on the spring meeting of Breton Wood Institutions at the Washington-based Fund headquarters, said the Fund was securing confirmation from international partners to meet the financing gap requirements of Pakistan.

In response to a question regarding the looming default risk facing Pakistan, she said: “Pakistan had not yet reached that level and it would not but the country required a sustainable policy framework to avert such risks”.

She said the lender has been working very hard with the authorities in Pakistan within the context of the current programme to make sure the country has the policy framework in place to prevent reaching the point of unsustainable debt.

“My hope is that with the goodwill of everyone, and the implementation of what has been already agreed by the Pakistan authorities, we can complete our current programme successfully,” Georgieva maintained.

Latest News3 days ago

Latest News3 days ago

Business3 days ago

Business3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Business3 days ago

Business3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago