Business

Pakistan, Saudi Arabia ink agreement to finance $1bn oil derivatives

-

Latest News2 days ago

Latest News2 days agoPoliovirus discovered in ten additional sewage samples

-

Business2 days ago

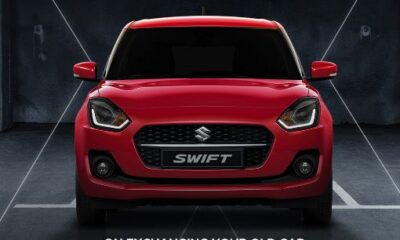

Business2 days agoSee the new rates when Pak Suzuki announces a significant decrease in car costs.

-

Business14 hours ago

Business14 hours ago“Ten companies express interest in purchasing PIA.”

-

Latest News2 days ago

Latest News2 days agoUS Ambassador Donald Blome praises Maryam’s portrayal of the Chief Minister of Punjab.

-

Business2 days ago

Business2 days agoPakistan will host an IMF team in May to discuss a new loan.

-

Business15 hours ago

Business15 hours agoSupport from the US for Pakistan’s IMF pact

-

Latest News2 days ago

Latest News2 days agoFO spokesperson: Pakistan will not cede bases to any foreign government.

-

Business14 hours ago

Business14 hours agoPakistan has $13.316 billion in total foreign reserves.