- ADB says recovery from COVID-19 impeded by external shocks.

- Increasing business, living costs affecting millions of Pakistanis.

- Loan to help manage inflation, food insecurity, slow commerce.

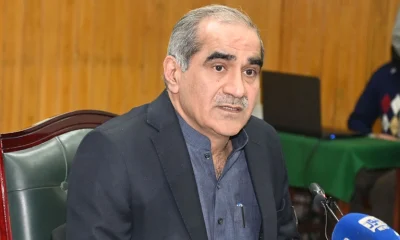

ISLAMABAD: Finance Minister Ishaq Dar Wednesday announced Asian Development Bank (ADB) had released $1.5 billion to Pakistan to help boost social protection, promote food security, and create jobs in the wake of super floods as well as global supply chain disruptions.

“Asian Development Bank has released funds $1.5 billion to Pakistan under BRACE program for the credit of Govt of Pakistan’s account with State Bank of Pakistan. AlhamdoLilah!” Dar said in a Twitter post.

The loan, provided under ADB’s Building Resilience with Active Countercyclical Expenditures (BRACE) Program, will help fund the government’s $2.3 billion countercyclical development expenditure program designed to cushion the impacts of external shocks, including the Russian invasion of Ukraine.

“Pakistan’s recovery from the COVID-19 pandemic has been impeded by external shocks,” said ADB Director General for Central and West Asia Yevgeniy Zhukov in a statement. “Increasing business costs and rising living expenses are affecting millions of Pakistanis, especially the poor and vulnerable. ADB’s program will help the government manage the impacts of high prices, increasing food insecurity, slowing business activity, and reducing income for vulnerable groups, many of whom are also reeling from the devastating floods.”

ADB’s financing will provide the fiscal space needed for the government to implement its countercyclical development expenditure package, which is designed to target the poorest families in Pakistan who are often disproportionately affected in times of crisis. The government’s support includes specific measures to promote gender empowerment and climate change adaptation, which have become even more important in light of the recent floods.

ADB’s assistance will help to expand the number of families receiving cash transfers from 7.9 million to 9 million, increase the number of children enrolled in primary and secondary schools, and enhance geographic coverage of health services and nutritional supplies for pregnant and lactating mothers and children under 2 years old.

ADB’s $1.5 billion countercyclical support is part of a significant response package to support people, livelihoods, and infrastructure in Pakistan in the wake of the recent floods which have affected over 33 million people and caused extensive damage to infrastructure and agriculture.

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Business3 days ago

Business3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Latest News3 days ago

Business3 days ago

Business3 days ago

Latest News3 days ago

Latest News3 days ago