PTI leader Abdul Aleem Khan, a former Punjab minister and a close aide of Prime Minister Imran Khan, announced on Monday that he would be joining...

Veteran film, TV and stage actor and director Masood Akhtar passed away today (March 5) in Lahore. The 82-year-old who was awarded the Pride of Performance...

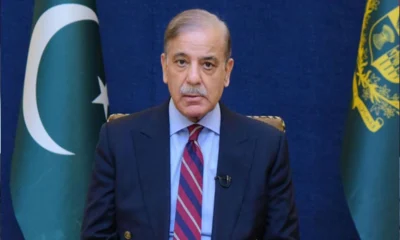

In a letter, Prime Minister Shehbaz Sharif congratulated President Donald Trump on taking office.The US Secretary of State has also received congratulations from Deputy Prime Minister...

President Recep Tayyip Erdogan and Prime Minister Muhammad Shehbaz Sharif have expressed their condolences for the devastating fire incident in North-Western Turkey.The Prime Minister expressed his...

The final portion of Prime Minister Muhammad Shehbaz Sharif’s speech, delivered in German during the World Bank’s Country Partnership framework launch ceremony.In honor of Martin Raiser,...

Four bills passed by both houses but returned by the president have been adopted by the Joint Sitting of Parliament. The opposition benches had nothing against...

Pakistan and Azerbaijan have committed to strengthening their economic connections by increasing their collaboration in a number of areas, including agriculture.During the 8th joint commission meeting...

The Combined Task Force-151 (CTF-151), a multinational organization established in 2009 in response to piracy assaults in the Gulf of Aden and off the eastern coast...

Lt-Gen (Retd) Nazir Ahmed, Chairman of the NAB, delivered plots worth Rs 70 billion and checks of Rs 97 crore to 8,310 different housing scheme beneficiaries....

Barrister Gohar, Chairman of the PTI, has claimed that the party’s founder has suspended negotiations, emphasizing that the government should declare the commission within seven days....

In response to the petitions for acquittal filed by Bushra Bibi and Imran Khan, the founders of the Pakistan Tehreek-e-Insaf (PTI), in the Toshakhana-II case, the...

In a strong condemnation of the Indian Army’s ongoing brutality and oppression in occupied Jammu and Kashmir, Prime Minister Shehbaz Sharif reaffirmed Pakistan’s unwavering political, moral,...